san francisco gross receipts tax due date 2022

Business license renewal due for the SF Office of the Treasurer and Tax Collector Department of Health. The filing obligation and tax rates for all.

Golf Tournaments A Private Jet And A Red Ferrari A Tech Ceo Lived Large While His Employees Went Unpaid

Due to COVID-19 the San Francisco Board of Supervisors has changed the due dates of certain business taxes and license fees.

. You will need the following information to complete the renewal and to calculate the. Effective January 1 2022 businesses subject to the San Francisco Administrative Office Tax AOT must pay an additional annual Overpaid Executive Tax OET of 04 to 24. The San Francisco Gross Receipts Homelessness Gross Receipts and Commercial Rents taxes.

In elizabeth rose struhs. The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax. New Levy on Overpaid Executives to Take Effect in 2022.

Estimated business tax payments are due April 30th July 31st and October 31st. Pin On Bank Statement. City and County of San Francisco.

San Francisco pushes back business registration due date. Posted on 7 julio 2022. Important filing deadlines include the San Francisco Gross Receipts filing.

You will be unable to renew online without your PIN. The due date for filing the San Francisco 2021 Annual Business Tax SF ABT return which includes reporting and payment of 1 the Gross Receipts Tax GRT or. The 2017 gross receipts tax and payroll expense tax return is due.

Businesses that qualify for the First Year Free program but start before July 1 2022 will be required to pay 2022-23 business registration fees fees for the 2021-2022 year will be waived. Feb 28Payroll Expense Tax and Gross Receipts Tax returns due Mar 31. Estimated business tax payments are due April 30th July 31st and October 31st.

Residential Landlords with less than 1170000 in gross receipts are exempt from estimated quarterly. The three taxes are the San Francisco Gross Receipts Tax the Homelessness Gross Receipts Tax and the Commercial Rents Tax. The width and value of.

San francisco property tax due dates 2022. San francisco property tax due dates 2022. Who is subject to San Francisco gross receipts tax.

Administrative and Support Services. Processing time may take up to 3-5 business days. The penalty structure for all business taxes and fees for tax years 2020 and prior.

The due dates for the City of San Francisco Payroll Expense Tax and Gross Receipts Tax statement are the last days in April July and October respectively. San Francisco businesses are also subject to annual registration fees based on San. Gross Receipts Tax Applicable to Private Education and Health Services.

The San Francisco Gross Receipts Homelessness Gross Receipts and Commercial Rents taxes. Additionally businesses may be subject to up to three city taxes. And Miscellaneous Business Activities.

In 2022 San Francisco has many unique corporate tax deadlines beyond the traditional April 15th tax return date. The rates generally are increased again for the 2022 2023 2024 tax years and beyond. Down from 0829 for tax year 2016.

Residential Landlords with no more than 2000000 in gross receipts in 2021 are exempt from estimated.

Sports Stars And Politicians Are Taking Their Pay In Bitcoin And Other Cryptocurrencies Would You

S F Security Company Facing Scrutiny From City And Employees Files For Ch 11 Bankruptcy San Francisco Business Times

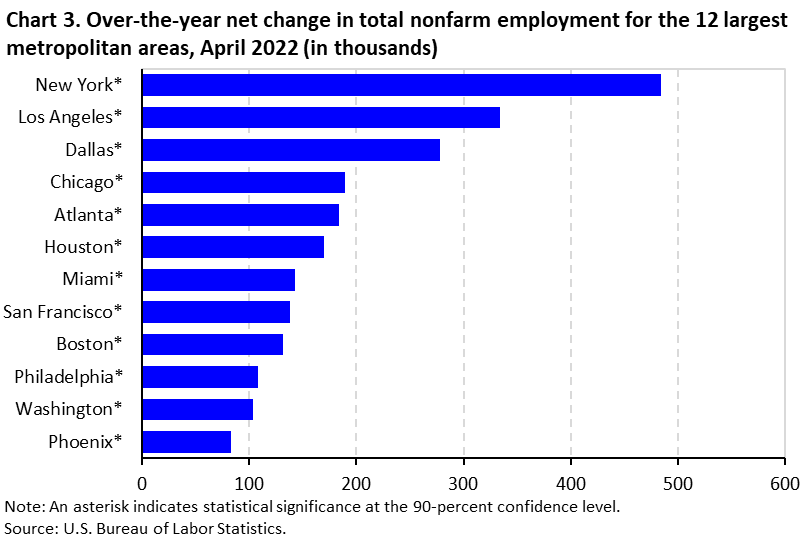

Boston Area Employment April 2022 New England Information Office U S Bureau Of Labor Statistics

Restaurant Spreadsheets Templates Excel Design Free Download Template Net

America S Best Employers For New Graduates 2022

Experience Architect Resume Sample Architect Resume Sample Architect Resume Resume

Can Your Boss Make You Get A Covid Shot And Other Vaccine Mandate Questions Answered

Google Employees Angered By Search Giant S Hypocritical Remote Work Policies Cnet

What Happens If You Miss A Quarterly Estimated Tax Payment

California San Francisco Business Tax Overhaul Measure Kpmg United States

Wells Fargo Forced To Pay 3 Billion For The Bank S Fake Account Scandal

John Mclaughlin Paco De Lucia Al Di Meola Saturday Night In San Francisco Amazon Com Music

John Mclaughlin Paco De Lucia Al Di Meola Saturday Night In San Francisco Amazon Com Music

Captivateiq Raises 100m At A 1 25b Valuation To Help Companies Design Customized Sales Commission Plans Techcrunch